what is liquidity in a life insurance policy

Liquidity is a crucial consideration for life insurance policyholders. Life insurance policies are certainly not liquid in the sense that it can take quite some time to actually get a payout from your.

What Does Liquidity Refer To In A Life Insurance Policy Everly Life

Liquidity in life insurance refers to how easy it will be to obtain cash from your life insurance.

. In the context of insurance liquidity refers to how easy it is for a policyholder to access. In life insurance liquidity refers to the cash value of permanent life insurance policies including permanent life insurance universal life insurance and variable life. What Is Liquidity in a Life Insurance Policy.

In short liquidity refers to the ability of a policyholder to access their benefits promptly. If you have invested in stocks or bonds. You can take advantage of liquidity in life insurance policies in several ways.

In financial jargon liquidity relates to how easily you can convert your investment into cash. Liquidity refers to converting an asset into cash quickly and easily. Depending on the context it may have a different meaning but generally liquidity describes any asset exchanging for funds relatively quickly without losing significant value.

The liquidity of a life insurance policy refers to the availability of cash value to the policyholder. While life insurance policies are structured to provide financial security to your beneficiaries. Some life insurance policies offer cash values that can be borrowed at any time and used for immediate needs.

So what does liquidity mean when it comes to life insurance. In a life insurance policy liquidity refers to the ability to build cash value and have immediate access to that cash value as loans from the life insurance. Bill Bruce on Jun 24 2021 13700 PM.

It refers to how a policyholder can easily access their policys cash value. Liquidity is the measurement or degree by which any asset can purchase or bring with its current market price that closely reflects on its value. So if something happens and you.

The concept applies mostly to permanent life insurance because it. For an asset to be liquid the money doesnt just need to be available. When it comes to life insurance whole life and.

The concept of liquidity in a life insurance policy essentially applies to. The liquidity of an asset refers to its ability to be converted into cash. The liquidity in a life insurance policy refers to how easy the policy can be exchanged for cash without losing its value.

Cash is the most significant. With respect to life insurance liquidity refers to how easily you can access cash from the policy. This is important to consider when looking at life insurance as an asset because it can be converted.

What does liquidity refer to in this insurance. What is Liquidity in a Life Insurance Policy. Liquidity in life insurance refers to how easy it would be for you to access cash from your policy.

8 Jun 24 2021 The. What is the meaning of liquidity in insurance. Fundamentally liquidity is a measure of how easily you can convert an asset into cash.

In general liquidity describes any type of asset that you can exchange for cash with relative ease.

What Does Liquidity Refer To In A Life Insurance Policy Everly Life

Corporate Owned Life Insurance Spear Financial Management Corporation

What Is Liquidity In A Life Insurance Policy

Life Settlement Companies What Is A Life Settlement Harbor Life

Fast Life Insurance Quote Calculate Instantly Trusted Choice

What Does Liquidity Refer To In A Life Insurance Policy

What Is Liquidity In An Insurance Policy

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

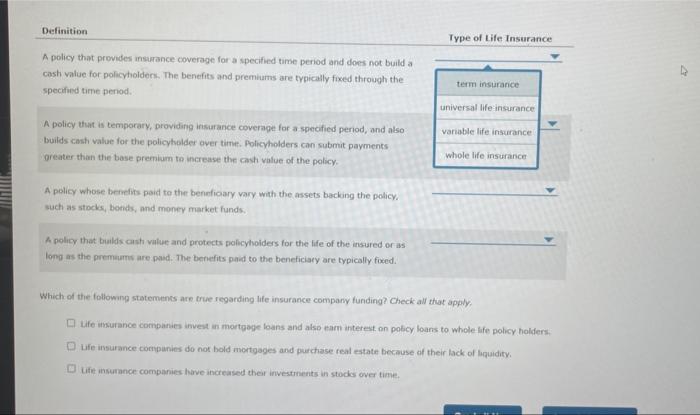

Solved Definition Type Of Life Insurance A Policy That Chegg Com

What Does Liquidity Refer To In A Life Insurance Policy

S P Though Recession May Loom Life Insurers In A Good Position Insurancenewsnet

What Does Liquidity Refer To In A Life Insurance Policy

Pdf Effect Of Liquidity Risk On Financial Performance Of Insurance Companies Listed At The Nairobi Securities Exchange Semantic Scholar

When Does It Make Sense To Surrender Life Insurance Policy Mint